/ Feb 07, 2026

The government is finally moving under the Indian context for speedy implementation of rooftop Solar across the Land with two novel modes of payment under the Prime Minister’s Surya Ghar Yojana (PM Surya Ghar), this decision is pivotal not just for the nation but also its mission towards renewable energy targets but the novel goals of 500 GW of renewable energy capacity by 2030.

These new two payments are essential to bring down the cost and availability of rooftop solar systems to an affordable level for homeowners, businesses, and any other stakeholders.

The Ministry of New and Renewable Energy (MNRE) has come out with two other payment modes under PM-Surya Ghar — Muft Bijli Yojana as a landmark step towards faster adoption of residential solar energy in states across India. The two, Renewable Energy Service Company (RESCO) model and the “Utility Led Aggregation Model (ULM) will offer consumers payment flexibility as well as payment security, the security of subsidies.

India’s PM Surya Ghar Yojana is paving the way for mass-scale rooftop solar adoption. While the Utility-Led Aggregation (ULA) model is gaining traction, especially in Rajasthan under the 150 units free electricity scheme, the RESCO model faces some key challenges. Let’s break it down:

Here the third-party entity, i.e., a RESCO invests in installing and owning the rooftop solar system. Consumers only pay what they consume (in scaling, this eliminates the need to pull upfront cash). This is an effort to provide solar more inclusively, particularly among households that would be priced out.

🔹 𝗪𝗵𝘆 𝗥𝗘𝗦𝗖𝗢 𝗠𝗶𝗴𝗵𝘁 𝗡𝗼𝘁 𝗪𝗼𝗿𝗸 𝗪𝗲𝗹𝗹 𝗳𝗼𝗿 𝗣𝗠 𝗦𝘂𝗿𝘆𝗮 𝗚𝗵𝗮𝗿

🔎 𝗙𝗼𝗿 𝗦𝗺𝗮𝗹𝗹 𝗣𝗿𝗼𝗷𝗲𝗰𝘁𝘀 (𝗨𝗽 𝘁𝗼 𝟯 𝗸𝗪):

💰 Affordable Loans Over RESCO Dependency – Consumers can now access ₹2 lakh loans at just 7% interest, making direct ownership more attractive.

🔄 Ownership = Better Returns – RESCO requires households to pay for power while operators retain system ownership for 5+ years. Owning outright ensures full control and savings from Day 1.

🔎 𝗙𝗼𝗿 𝗟𝗮𝗿𝗴𝗲𝗿 𝗣𝗿𝗼𝗷𝗲𝗰𝘁𝘀 (𝗔𝗯𝗼𝘃𝗲 𝟱 𝗸𝗪):

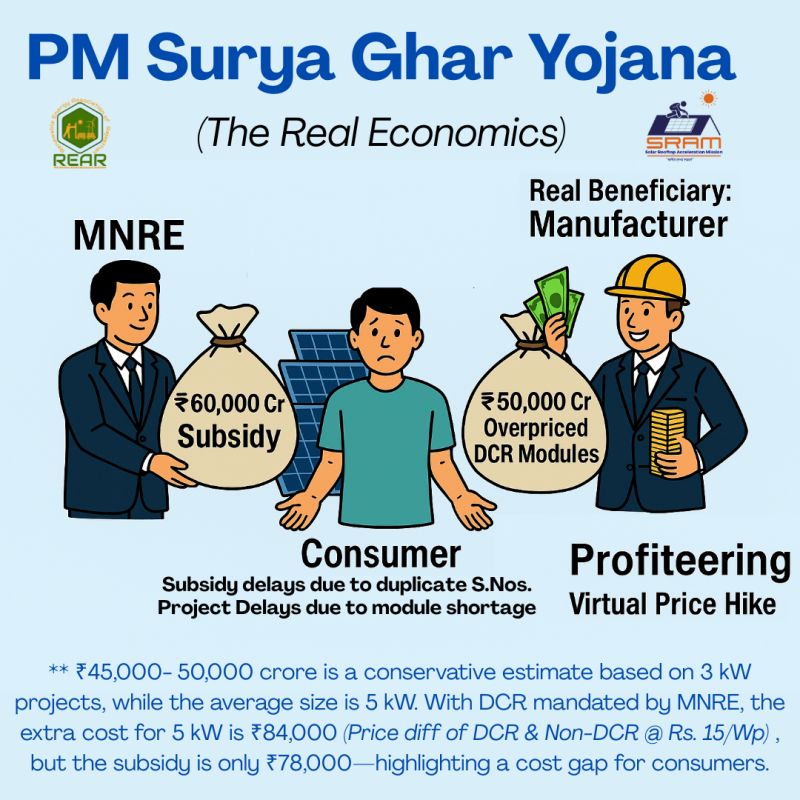

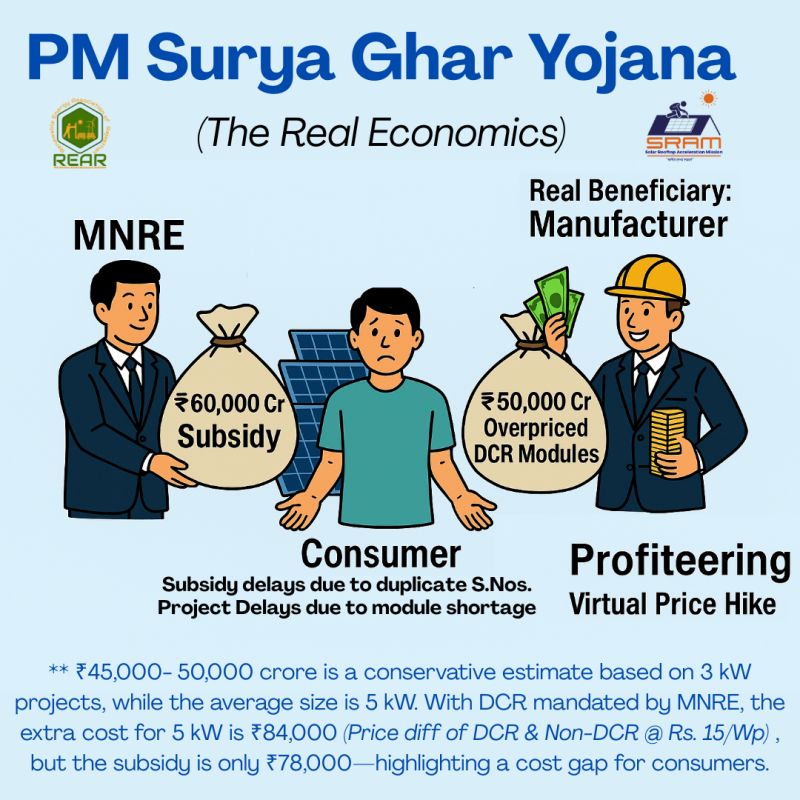

📉 High Costs Make RESCO Less Feasible – The Domestic Content Requirement (DCR) increases per-unit energy costs, making RESCO tariffs less competitive.

👨💼 Financially Capable Consumers Prefer Ownership – Households with ₹5000+ monthly electricity bills can afford to own solar, ensuring long-term savings and energy independence.

ULA in Rajasthan: A DISCOM-Driven Push for Solar

In the ULA model, power distribution companies ( DISCOMs) and such state-designated entities take the lead on installing rooftop solar projects on a household level. Through the centralized approach, utilities own and manage expertise enabling broad ups to sell/make installation approaches to scale quality installations through effective maintenance.

✅ Being actively implemented under the 150-unit free electricity scheme.

✅ DISCOMs handle aggregation, approvals, and deployment, making adoption hassle-free for consumers.

✅ Helps scale up solar installations while ensuring streamlined execution.

𝗧𝗵𝗲 𝗕𝗶𝗴𝗴𝗲𝗿 𝗣𝗶𝗰𝘁𝘂𝗿𝗲

✅ ULA Model = 𝘚𝘤𝘢𝘭𝘦𝘥 & 𝘌𝘧𝘧𝘪𝘤𝘪𝘦𝘯𝘵 𝘚𝘰𝘭𝘢𝘳 𝘈𝘥𝘰𝘱𝘵𝘪𝘰𝘯 𝘸𝘪𝘵𝘩 𝘨𝘰𝘷𝘦𝘳𝘯𝘮𝘦𝘯𝘵-𝘣𝘢𝘤𝘬𝘦𝘥 𝘪𝘮𝘱𝘭𝘦𝘮𝘦𝘯𝘵𝘢𝘵𝘪𝘰𝘯.

❌ RESCO Model 𝘍𝘢𝘤𝘦𝘴 𝘌𝘤𝘰𝘯𝘰𝘮𝘪𝘤 & 𝘝𝘪𝘢𝘣𝘪𝘭𝘪𝘵𝘺 𝘊𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘦𝘴 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘰𝘴𝘵 𝘧𝘢𝘤𝘵𝘰𝘳𝘴 𝘢𝘯𝘥 𝘣𝘦𝘵𝘵𝘦𝘳 𝘭𝘰𝘢𝘯 𝘰𝘱𝘵𝘪𝘰𝘯𝘴.

The future of solar is about empowering consumers—whether through DISCOM-led aggregation or affordable financing options. Let’s seize this opportunity to make India a solar-powered nation!

MNRE has also approved ₹100 crore capital designation for the corpus fund under the Payment Security Mechanism (PSM) supporting these models. The fund is intended to lower the risks associated with investments in grid-connected rooftop solar models under the RESCO (recurrent payments to discoms) model in the residential sector.

PSM supports investors having a risk-adjusted take with the hopes of getting more entities in play for rooftop solar.

The scheme guidelines also state that ‘Central Financial Assistance (CFA) will be provided for RESCO and ULA modalities in consultation with states.

They are provided to help keep the cost for consumers as low as possible and make it economically feasible to install solar panels on top of homes. PSM plus CFA is the ideal breeding ground for both investors and consumers, just like what we expected from the solar energy that will be used on a wide scale.

Models that remove the initial cost of capital from households allow them to transition more easily to solar.

PSM acts as a virtual safety net for investors so that more companies can take up RESCO services.

This is because in the ULA model DISCOMs are mandated to roll out leads for adoption which makes the consumer’s adoption experience more streamlined and consistent.

One important thing to mention is that these new payment methods complement the existing modes that can be availed through the national portal. Consumers will have a capex model of their preference and are still able to pursue that.

RESCO/UJA models mean something to the consumers, but bringing these two more into the mix will add some degrees of flexibility—to cater to more consumer needs.

The energy sector of India has recently made a big shift to encourage cleaner and renewable energy sources. India has committed to achieving net-zero emissions by 2070 as part of its pledge to combat climate change and reduce carbon emissions.

Rooftop solar is very central to this transformation. The program provides a means for people and enterprises to install solar energy directly on their rooftops where it takes the intangibility out of buying green and near elimination of reliance on grid electricity from dirty fossil fuels.

Launched by the Indian government, PM Surya Ghar Yojana will leap forward in rooftop solar installations across buildings anytime soon, especially domestic and enterprise. To foster the adoption of rooftop solar, the government wants to enable a regulation-free decentralized, and sustainable energy model in which citizens generate their energy.

Although rooftop solar has quite a few advantages its uptake has been restrained, mostly on the financial front, as far as we know. The initial high installation costs, along with a payback period that makes most people shrug have put off many prospective users. Government two new payment methods are intended to solve these challenges at their root.

This involves taking a bank loan for the installation of rooftop solar systems. With this approach, consumers borrow from a participating bank or financial institution the full cost of their solar system.

The loan would be paid back over a fixed period, at very low interest rates with additional incentives from the government. The repayment schedule is structured so that it feigns the repayment coming from savings generated by the rooftop solar system and users will not be any burdens.

It also hopes to address a leading cause of adoption hesitancy — pricing by taking the cost out of rooftop solar installations at the outset via this method. Providing low-interest loans and backing with government incentives, the government is aiming to make solar power a cost-competitive option for all sizes of households and businesses.

The effects of these two new payment methods will reverberate across the entire solar cell ecosystem in India. So here are some of the key benefits:

Even for PAYG and loan financing, the big expense of rooftop solar systems is so much lower that it has the cost squeeze off underwritten new installation prospects. Breaking the cost into smaller amounts means consumers can consume solar energy without necessarily paying everything upfront and the government is helping achieve this.

Rooftop solar comes with a lot of benefits and we will be able to provide proper electricity to a larger section of consumers at less price if those (accessible) payment options were available. Hence this will augment several rooftop solar installations and they will churn out a huge chunk of India’s renewable energy aspirations.

Switching to rooftop solar offers savings in the long form of electricity bills. So they can not be dependent on the grid power, which is also very costly as a consequence people will generate their electricity. These savings on power bills to be had going forward will more than cover what a solar installation costs hence will be financially viable.

Rooftop solar is crucial in meeting India’s ambitious renewable energy targets and it targets the Karnataka market. New payment methods will make rooftop solar easier and cheaper for India and allow it to build more solar capacity allowing it to reduce the use of fossil fuels closer to its climate goals.

The spike in demand for rooftop solar will not only be good for consumers but will create jobs in the manufacturing and installation of solar too. When more people opt for solar systems, the increasing demand will be offset by a rise in orders for solar panels and other components, which will help to revitalize local manufacturing. Then it will lead to job openings in the installation and maintenance of solar systems.

The acceptances of these two new revenue streams comprise part of the larger action implemented by the Indian govt for a cleaner sustainable future while reducing carbon emissions. India plans to achieve 500 GW of renewable energy by 2030 as part of its commitment under the Paris Agreement, a substantial slice of which will be solar energy.

Rooftop solar has a lot of room to deliver to this target as it simply utilizes the largely unutilized rooftop space available across the country. India can reduce its over-dependence on conventional energy sources thus slowing climate change and improving energy security simply by making solar power granola-tastic for them to use.

Approval of these two PM Surya Ghar: Muft Bijli Yojana stream-lined payment methods under whose umbrella by Centre signifies a milestone towards large-scale deployment of rooftop solar energy in India. With tackling the financial barriers and associated payment security concerns, RESCO, as well as ULA are gearing to take solar power closer to homes across the country, a key part of India’s renewable energy goals

These long-term gains (cut energy-to-cost and green portfolio) are enormous. India is likely to march as a world leader in the renewable energy sector with government initiatives towards its greener future.

India’s renewable energy goals are closer to reality thanks to the giant step India is taking towards it with the Indian government through policies that promote a Sustainable Future, and smashes rampant enthusiasm from PM Surya Ghar Yojana will act as a fulcrum for the transition to Green power in the country.

The government is finally moving under the Indian context for speedy implementation of rooftop Solar across the Land with two novel modes of payment under the Prime Minister’s Surya Ghar Yojana (PM Surya Ghar), this decision is pivotal not just for the nation but also its mission towards renewable energy targets but the novel goals of 500 GW of renewable energy capacity by 2030.

These new two payments are essential to bring down the cost and availability of rooftop solar systems to an affordable level for homeowners, businesses, and any other stakeholders.

The Ministry of New and Renewable Energy (MNRE) has come out with two other payment modes under PM-Surya Ghar — Muft Bijli Yojana as a landmark step towards faster adoption of residential solar energy in states across India. The two, Renewable Energy Service Company (RESCO) model and the “Utility Led Aggregation Model (ULM) will offer consumers payment flexibility as well as payment security, the security of subsidies.

India’s PM Surya Ghar Yojana is paving the way for mass-scale rooftop solar adoption. While the Utility-Led Aggregation (ULA) model is gaining traction, especially in Rajasthan under the 150 units free electricity scheme, the RESCO model faces some key challenges. Let’s break it down:

Here the third-party entity, i.e., a RESCO invests in installing and owning the rooftop solar system. Consumers only pay what they consume (in scaling, this eliminates the need to pull upfront cash). This is an effort to provide solar more inclusively, particularly among households that would be priced out.

🔹 𝗪𝗵𝘆 𝗥𝗘𝗦𝗖𝗢 𝗠𝗶𝗴𝗵𝘁 𝗡𝗼𝘁 𝗪𝗼𝗿𝗸 𝗪𝗲𝗹𝗹 𝗳𝗼𝗿 𝗣𝗠 𝗦𝘂𝗿𝘆𝗮 𝗚𝗵𝗮𝗿

🔎 𝗙𝗼𝗿 𝗦𝗺𝗮𝗹𝗹 𝗣𝗿𝗼𝗷𝗲𝗰𝘁𝘀 (𝗨𝗽 𝘁𝗼 𝟯 𝗸𝗪):

💰 Affordable Loans Over RESCO Dependency – Consumers can now access ₹2 lakh loans at just 7% interest, making direct ownership more attractive.

🔄 Ownership = Better Returns – RESCO requires households to pay for power while operators retain system ownership for 5+ years. Owning outright ensures full control and savings from Day 1.

🔎 𝗙𝗼𝗿 𝗟𝗮𝗿𝗴𝗲𝗿 𝗣𝗿𝗼𝗷𝗲𝗰𝘁𝘀 (𝗔𝗯𝗼𝘃𝗲 𝟱 𝗸𝗪):

📉 High Costs Make RESCO Less Feasible – The Domestic Content Requirement (DCR) increases per-unit energy costs, making RESCO tariffs less competitive.

👨💼 Financially Capable Consumers Prefer Ownership – Households with ₹5000+ monthly electricity bills can afford to own solar, ensuring long-term savings and energy independence.

ULA in Rajasthan: A DISCOM-Driven Push for Solar

In the ULA model, power distribution companies ( DISCOMs) and such state-designated entities take the lead on installing rooftop solar projects on a household level. Through the centralized approach, utilities own and manage expertise enabling broad ups to sell/make installation approaches to scale quality installations through effective maintenance.

✅ Being actively implemented under the 150-unit free electricity scheme.

✅ DISCOMs handle aggregation, approvals, and deployment, making adoption hassle-free for consumers.

✅ Helps scale up solar installations while ensuring streamlined execution.

𝗧𝗵𝗲 𝗕𝗶𝗴𝗴𝗲𝗿 𝗣𝗶𝗰𝘁𝘂𝗿𝗲

✅ ULA Model = 𝘚𝘤𝘢𝘭𝘦𝘥 & 𝘌𝘧𝘧𝘪𝘤𝘪𝘦𝘯𝘵 𝘚𝘰𝘭𝘢𝘳 𝘈𝘥𝘰𝘱𝘵𝘪𝘰𝘯 𝘸𝘪𝘵𝘩 𝘨𝘰𝘷𝘦𝘳𝘯𝘮𝘦𝘯𝘵-𝘣𝘢𝘤𝘬𝘦𝘥 𝘪𝘮𝘱𝘭𝘦𝘮𝘦𝘯𝘵𝘢𝘵𝘪𝘰𝘯.

❌ RESCO Model 𝘍𝘢𝘤𝘦𝘴 𝘌𝘤𝘰𝘯𝘰𝘮𝘪𝘤 & 𝘝𝘪𝘢𝘣𝘪𝘭𝘪𝘵𝘺 𝘊𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘦𝘴 𝘥𝘶𝘦 𝘵𝘰 𝘤𝘰𝘴𝘵 𝘧𝘢𝘤𝘵𝘰𝘳𝘴 𝘢𝘯𝘥 𝘣𝘦𝘵𝘵𝘦𝘳 𝘭𝘰𝘢𝘯 𝘰𝘱𝘵𝘪𝘰𝘯𝘴.

The future of solar is about empowering consumers—whether through DISCOM-led aggregation or affordable financing options. Let’s seize this opportunity to make India a solar-powered nation!

MNRE has also approved ₹100 crore capital designation for the corpus fund under the Payment Security Mechanism (PSM) supporting these models. The fund is intended to lower the risks associated with investments in grid-connected rooftop solar models under the RESCO (recurrent payments to discoms) model in the residential sector.

PSM supports investors having a risk-adjusted take with the hopes of getting more entities in play for rooftop solar.

The scheme guidelines also state that ‘Central Financial Assistance (CFA) will be provided for RESCO and ULA modalities in consultation with states.

They are provided to help keep the cost for consumers as low as possible and make it economically feasible to install solar panels on top of homes. PSM plus CFA is the ideal breeding ground for both investors and consumers, just like what we expected from the solar energy that will be used on a wide scale.

Models that remove the initial cost of capital from households allow them to transition more easily to solar.

PSM acts as a virtual safety net for investors so that more companies can take up RESCO services.

This is because in the ULA model DISCOMs are mandated to roll out leads for adoption which makes the consumer’s adoption experience more streamlined and consistent.

One important thing to mention is that these new payment methods complement the existing modes that can be availed through the national portal. Consumers will have a capex model of their preference and are still able to pursue that.

RESCO/UJA models mean something to the consumers, but bringing these two more into the mix will add some degrees of flexibility—to cater to more consumer needs.

The energy sector of India has recently made a big shift to encourage cleaner and renewable energy sources. India has committed to achieving net-zero emissions by 2070 as part of its pledge to combat climate change and reduce carbon emissions.

Rooftop solar is very central to this transformation. The program provides a means for people and enterprises to install solar energy directly on their rooftops where it takes the intangibility out of buying green and near elimination of reliance on grid electricity from dirty fossil fuels.

Launched by the Indian government, PM Surya Ghar Yojana will leap forward in rooftop solar installations across buildings anytime soon, especially domestic and enterprise. To foster the adoption of rooftop solar, the government wants to enable a regulation-free decentralized, and sustainable energy model in which citizens generate their energy.

Although rooftop solar has quite a few advantages its uptake has been restrained, mostly on the financial front, as far as we know. The initial high installation costs, along with a payback period that makes most people shrug have put off many prospective users. Government two new payment methods are intended to solve these challenges at their root.

This involves taking a bank loan for the installation of rooftop solar systems. With this approach, consumers borrow from a participating bank or financial institution the full cost of their solar system.

The loan would be paid back over a fixed period, at very low interest rates with additional incentives from the government. The repayment schedule is structured so that it feigns the repayment coming from savings generated by the rooftop solar system and users will not be any burdens.

It also hopes to address a leading cause of adoption hesitancy — pricing by taking the cost out of rooftop solar installations at the outset via this method. Providing low-interest loans and backing with government incentives, the government is aiming to make solar power a cost-competitive option for all sizes of households and businesses.

The effects of these two new payment methods will reverberate across the entire solar cell ecosystem in India. So here are some of the key benefits:

Even for PAYG and loan financing, the big expense of rooftop solar systems is so much lower that it has the cost squeeze off underwritten new installation prospects. Breaking the cost into smaller amounts means consumers can consume solar energy without necessarily paying everything upfront and the government is helping achieve this.

Rooftop solar comes with a lot of benefits and we will be able to provide proper electricity to a larger section of consumers at less price if those (accessible) payment options were available. Hence this will augment several rooftop solar installations and they will churn out a huge chunk of India’s renewable energy aspirations.

Switching to rooftop solar offers savings in the long form of electricity bills. So they can not be dependent on the grid power, which is also very costly as a consequence people will generate their electricity. These savings on power bills to be had going forward will more than cover what a solar installation costs hence will be financially viable.

Rooftop solar is crucial in meeting India’s ambitious renewable energy targets and it targets the Karnataka market. New payment methods will make rooftop solar easier and cheaper for India and allow it to build more solar capacity allowing it to reduce the use of fossil fuels closer to its climate goals.

The spike in demand for rooftop solar will not only be good for consumers but will create jobs in the manufacturing and installation of solar too. When more people opt for solar systems, the increasing demand will be offset by a rise in orders for solar panels and other components, which will help to revitalize local manufacturing. Then it will lead to job openings in the installation and maintenance of solar systems.

The acceptances of these two new revenue streams comprise part of the larger action implemented by the Indian govt for a cleaner sustainable future while reducing carbon emissions. India plans to achieve 500 GW of renewable energy by 2030 as part of its commitment under the Paris Agreement, a substantial slice of which will be solar energy.

Rooftop solar has a lot of room to deliver to this target as it simply utilizes the largely unutilized rooftop space available across the country. India can reduce its over-dependence on conventional energy sources thus slowing climate change and improving energy security simply by making solar power granola-tastic for them to use.

Approval of these two PM Surya Ghar: Muft Bijli Yojana stream-lined payment methods under whose umbrella by Centre signifies a milestone towards large-scale deployment of rooftop solar energy in India. With tackling the financial barriers and associated payment security concerns, RESCO, as well as ULA are gearing to take solar power closer to homes across the country, a key part of India’s renewable energy goals

These long-term gains (cut energy-to-cost and green portfolio) are enormous. India is likely to march as a world leader in the renewable energy sector with government initiatives towards its greener future.

India’s renewable energy goals are closer to reality thanks to the giant step India is taking towards it with the Indian government through policies that promote a Sustainable Future, and smashes rampant enthusiasm from PM Surya Ghar Yojana will act as a fulcrum for the transition to Green power in the country.

Copyright Solar Journal Hub. 2025