Many investors struggle to identify the right solar stock in India, especially with the market flooded by companies making big promises but delivering inconsistent results. This uncertainty can lead to poor investment decisions, missed opportunities, and financial setbacks in a sector that’s otherwise full of potential. With India’s growing push toward renewable energy, the pressure to choose wisely has never been higher. In this article, we’ll explore the top-performing solar stocks for 2025 — helping you make a more informed, confident investment in the country’s clean energy future.

Table of Contents

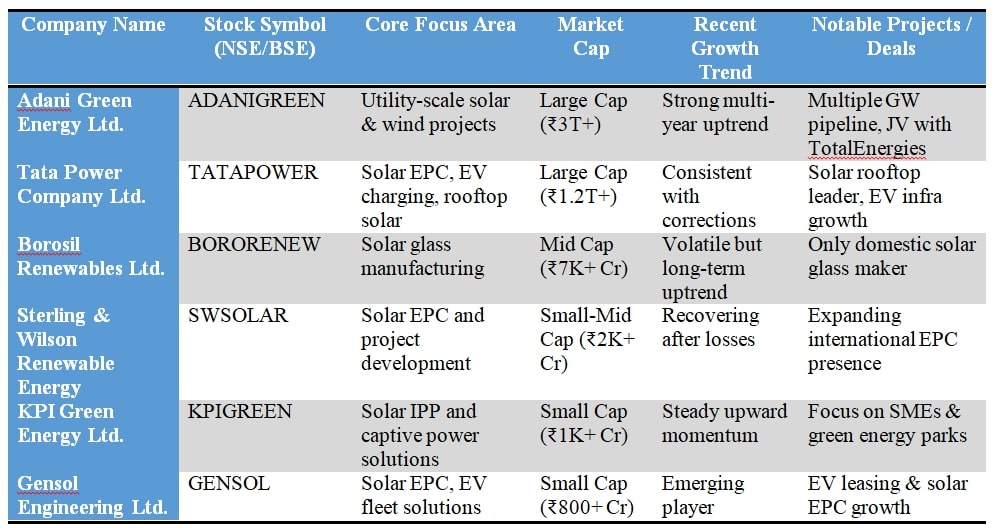

ToggleTop Solar Stocks in India – 2025 Comparison Table

Why Invest in Solar Energy Stocks in India?

India is a global leader in solar energy. The country solar business has grown significantly, which may surprise you. Lets examine this solar energy stocks to invest in India and why investors worldwide are interested in India solar business.

India had 2.6 GW of solar capacity. That amount has risen to 84.27 GW today. Not just growth a solar explosion. Thanks to this extraordinary rise, India is now the world 5th largest solar power generator.

What is causing this massive growth, several variables contribute but the Indian government commitment to renewable energy is the main one. India has fostered solar energy growth with ambitious aims and supportive regulations.

The strategic benefits of best renewable energy stocks India effort go beyond stunning figures. The country is adopting solar power. India can meet its climate obligations by using clean and green solar energy to reduce carbon emissions. India becomes less subject to global price swings by reducing fossil fuel imports. India tremendous solar power growth is a perfect example of environmental and economic alignment. Both the planet and the economy appear good.

Looking ahead, Solar sector stocks India seems brighter than ever. The sector will flourish with government assistance and investment interest. Solar energy will become more important in India energy mix as technology improves and costs fall.

Investors in the Indian solar business are seeing an excellent opportunity. India solar business appeals to clean energy revolutionists with its ambitious goals, supportive legislation and tremendous untapped potential. Remember that investing in the Indian solar sector is investing in a sustainable future, not just a stock. India is moving toward a solar powered future.

Best Solar Energy Stocks in India 2025: An Overview

Indian solar energy is expected to rise in 2025. Top solar stocks India 2025 to watch if you are investing in this growing market.

Adani Green Energy Ltd

Adani Green Energy leads India renewable energy sector. This stock could transform your portfolio with its goal of becoming the world largest solar power company by 2025. Investors seeking to profit from India green energy revolution should consider the company strong project pipeline and financial backing.

Adani Green integrated solar power generation sets it differently. The company end to end capabilities provide it with a market advantage by manufacturing solar panels and building large scale solar farms. Watch their worldwide expansion, which could boost growth in the following years.

Key metrics:

EPS: ₹2.35

ROE: 4.91%

Tata Power (Renewables segment)

Waaree Energies (if IPO listed)

BF Utilities Ltd

Consider BF Utilities for a diversified renewable energy investment. While not solely focused on solar, the corporation has strategically increased its solar power producing capacity. Their infrastructure construction experience and growing solar portfolio enable them to profit from India clean energy push.

BF Utilities excels at synergy across its business sectors. This may increase solar operations profitability and cost efficiency. The company diversification may limit growth compared to pure play solar firms.

Key metrics:

EPS: ₹6.71

ROE: 15.33%

Orient Green Power Company Ltd

Orient Green Power Company offers a riskier but better return opportunity. As India solar sector grows, this smaller stock might develop rapidly. Combining wind and solar power gives the organization a balanced renewable energy strategy.

Orient Green Power lean operating style and key relationships should help it scale swiftly as solar power demand rises. However, tiny enterprises like this typically struggle with finance and competition from larger ones.

Key metrics:

Earning per share (EPS): ₹-0.21

Return on equity (ROE): -2.10%

KKV Agro Powers Ltd

KKV Agro Powers solar agricultural hybrid offers a unique option. This novel strategy could benefit rural India, which needs clean energy and agricultural support. The company concentration on smaller solar projects and local market knowledge offers it an edge in some places.

It may not be as large as other solar firms. Still, its particular focus and potential for rapid expansion in underdeveloped markets make it an appealing option for solar portfolio diversifiers.

Key metrics:

EPS: ₹4.76

ROE: 4.46%

SJVN Ltd

Last but not least, monitor SJVN Ltd. SJVN receives government assistance and resources essential in the capital intensive solar business as a public sector venture. The corporation is rapidly developing its solar portfolio with ambitious ambitions for the future years.

SJVN can capitalize on India rising solar market due to its large scale power project experience and focus on solar energy. The company strong finances and government backing may reassure investors leery about renewable energy equities volatility.

Key metrics:

EPS: ₹2.55

ROE: 6.87%

When choosing high growth solar stocks India for your 2025 investment strategy, investigate them and determine how they fit your investment goals and risk tolerance. The Indian solar energy market has enormous prospects but it has risks and obstacles like any investment.

Key Factors to Consider Before Investing

When choosing Indian solar companies listed in stock market, examine various aspects break them down.

Financial Health and Performance

First examine the company finances. Check debt, profit margins and sales growth. Strong balance sheets and steady profitability are good. Look for companies that consistently outperform profit projections.

Market Position and Competitive Advantage

Do you think the corporation is big in solar. Consider its market share and any proprietary technology or patents that give it an edge. Find companies with strong brands and diverse consumer bases.

Government Policies and Incentives

Best green energy stocks India 2025 future depends on government backing. Research which companies will profit most from existing and future legislation. Firms with policymaker connections may benefit.

Innovation and R&D Investment

Solar technology is advancing rapidly. R&D intensive companies are more likely to stay ahead. Look for companies developing energy efficient panels or storage systems.

Environmental Social and Governance (ESG) Factors

Think about a company sustainability and governance. Firms with high ESG ratings perform better over time and attract more investors.

Final Verdict: Which Stock Looks Most Promising for 2025?

Make wise knowledgeable solar stock investment India. You are investing in renewable energy future, not merely tossing darts at a board. How do you choose the solar stock recommendations India?

Research is Your Best Friend

Finish your schoolwork first. Investigate potential companies finances. Check their debt, profit margins and revenue growth. Strong fundamentals help a company withstand market storms and shine.

Technology Matters

Solar energy is fast paced and requires innovation. Search for R&D intensive companies. Tomorrow market leaders may create more efficient solar panels or energy storage systems.

Market Position and Scale

Consider the company market share and scalability. Do not dismiss agile startups with disruptive potential because more prominent players have more resources. Over time, the underdog can beat the big dogs.

Here is future of solar stocks in India. Although forecasting the best stock is difficult, these companies are well positioned to ride the solar energy wave. Solar can be volatile, so do your research before investing. Monitor government policy, technology and energy developments. Your investment approach should match your risk tolerance and financial goals. Solar in India has a bright future, so investing now could pay off.

FAQs

Yes, they do — but not always directly. When fossil fuel prices (like oil and coal) rise, solar energy becomes more attractive due to its stable and predictable costs. This often boosts investor sentiment toward renewable energy stocks, including solar. However, other factors like government policy, raw material costs, and global supply chains can also affect solar stock performance.

Given India’s strong push toward renewable energy and long-term policy support, many experts consider this a favorable time to explore solar energy stocks. With declining costs, technological innovation, and increasing adoption across residential, commercial, and utility sectors, the solar segment offers growth potential — especially for long-term investors.

Several factors are fueling this growth:

• Government support through incentives and clear targets

• Rising energy demand and climate goals

• Falling installation and panel costs

• Corporate ESG commitments and global climate pacts

Together, these make solar companies more profitable and appealing to investors.

As of 2025, the Bhadla Solar Park in Rajasthan is the largest solar power project in India and one of the biggest in the world. Spread across over 14,000 acres, it has a capacity of 2,245 MW. Its scale and efficiency showcase India’s commitment to large-scale clean energy production.

Solar penny stocks are low-priced shares (typically under ₹100) of smaller or emerging solar-related companies. Some examples (as of recent data) include:

• Websol Energy Systems Ltd.

• Ujaas Energy Ltd.

• Urja Global Ltd.

Note: Penny stocks can be highly volatile and speculative. Always do thorough research and consult a financial advisor before investing in them.